0 +

Customers

0 +

Agents

0 +

Loans

0 %

NTC

Streamlining Priority Sector Lending for Financial Institutions

We empower Financial Institutions to build secure full stack lending journeys with optimised collections efficiencies, ensuring compliance with RBI digital lending guidelines.

Digital Lending Experience

Our end-to-end digital process eliminates manual document uploads and OCR. All required documents are fetched directly from authorized sources via APIs.

Digilocker Integration

Our platform integrates with Digilocker for seamless, secure KYC and KYB journeys with authentic digital document verification.

Account Aggregator

Our platform enables secure, real-time bank statement analysis leveraging consent-based data from Financial Information Providers (FIPs).

Credit Information Companies (CIC)

Multi-bureau integration for comprehensive consumer credit scores and a wide range of credit-related metadata.

Integration with LOS, LMS, and CBS

Our technology seamlessly integrates with existing LOS, LMS, and Core Banking systems. We also provide standalone systems for those seeking comprehensive solutions.

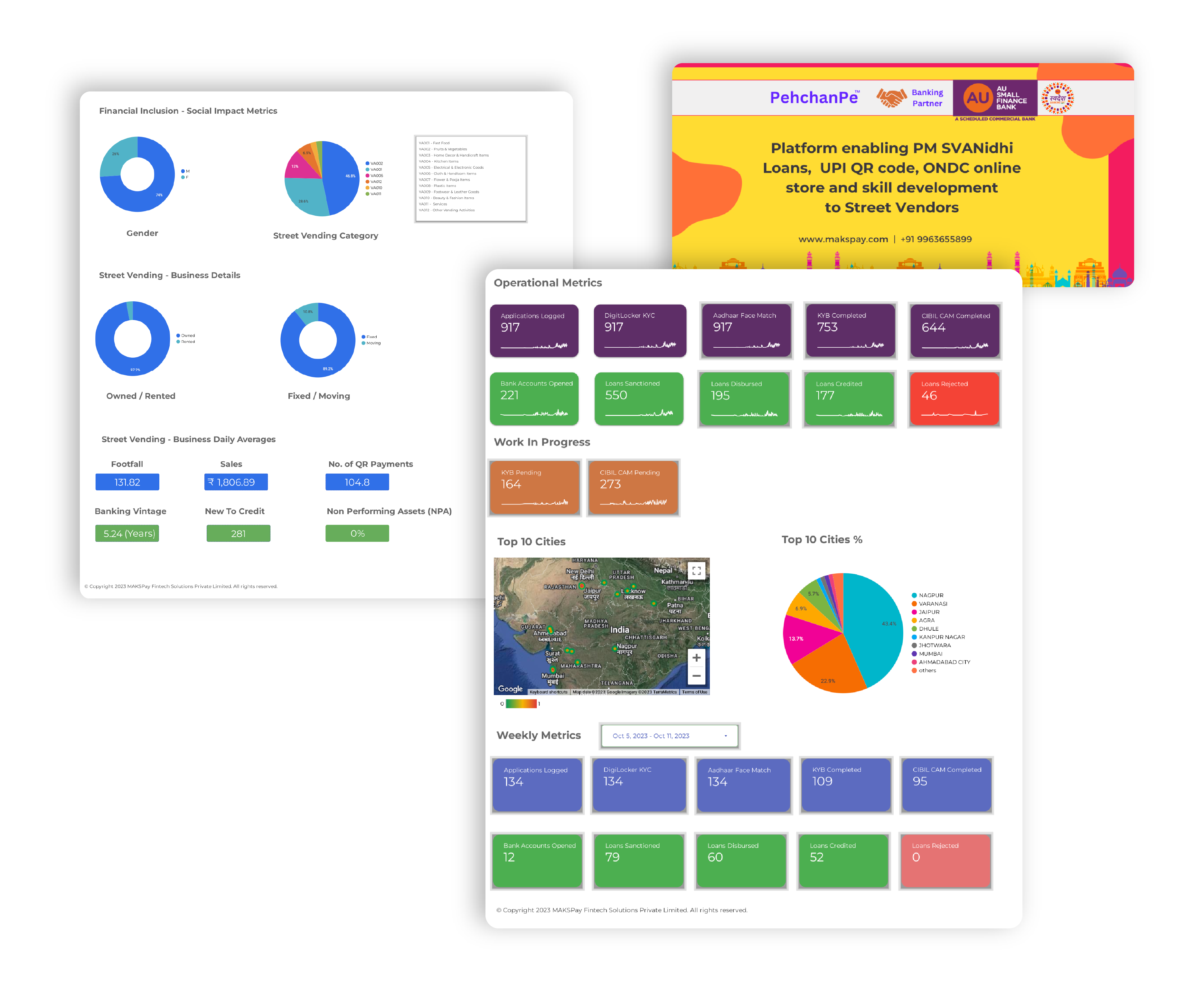

PehchanPe UPI QR Code

Our platform revolutionizes loan repayment through an automated process and innovative daily instalment options using the PehchanPe Collections QR Code on UPI.

AI/ML Driven Analytics

Our platform leverages a powerful Business Rule Engine, and scorecard based predictions to provide comprehensive insights for informed loan decision-making.

Default Risk Monitoring

Minimize defaults and NPAs through continuous risk monitoring, dynamic policy adjustments, and proactive risk identification. Streamlined NPA resolution ensures effective default risk mitigation.

Loan Management Dashboard and Insights

- Comprehensive insights

- Real-time data and analytics

- Drive operational efficiency and profitability

Incubated with RBIH

PehchanPe was featured in Reserve Bank Innovation Hub and winner of RBIH Swanari Techsprint 2022.

Our customers have nice things to say about us

Discover firsthand testimonials from our satisfied customers, showcasing their experiences with our platform. Hear their voices, embrace their stories.

Helping Banks and NBFCs to drive financial inclusion

Book a DemoWe empower Financial Institutions to build secure full stack lending journeys with optimised collections efficiencies, ensuring compliance with RBI digital lending guidelines.